The Impact of Regulation on Cylinder Oil Lubricant Selection (Part I)

Thursday, 19/08/2021, 11:05 GMT+7

I. INTRODUCTION

WHY IS THE LUBRICATION LANDSCAPE CHANGING?

The introduction of emissions and efficiency-based regulations has catalysed a change in the way ships are operated, fuel types that are used and the technologies installed on-board ships.

A range of different fuels are now being used to power ships alongside traditional HFO such as heavy fuel oil (HFO).

Engine designs are evolving to satisfy efficiency demands, which in turn is impacting operating conditions within the engine cylinders’ machinery.

To summarise, three key changes in ship operation, fuel use and engine development that have taken place in the last few years are:

• Changing operational patterns that favour lower-load operations (slow steaming).

• The use of marine fuels alternative to heavy fuel oil (HFO) that have a wider variation of sulphur content.

• The development of new engine designs led by emissions reduction legislation and need for improved energy efficiency.

All of these factors influence the selection of suitable of cylinder oil lubricants, now and in the future.

WHY IS THIS IMPORTANT TO SHIP OPERATORS?

These changes mean that it is vital that different specifications of cylinder oils designed for specific operating conditions and fuel types are matched with ship fuel and engine operating requirements.

Failure to do so can have severe cost implications including significant machinery damage and potentially even catastrophic engine failure incidents.

Incorrect lubricant choice and feed rate management can also significantly raise day-to-day operating costs by driving a higher feed rate than is necessary.

Therefore, choosing the right cylinder oil lubricant at the correct feed rate and matching your cylinder oil to the engine conditions is imperative.

This independent guidance was developed to support informed marine lubricant decisions. It provides information on the current regulations that influence cylinder oil lubricant choices.

It also examines future regulations that must be taken into consideration when making cylinder oil lubricant procurement decisions. The impact of different fuel types and technologies on lubricant selection is also provided.

What is the purpose of a cylinder oil?

The cylinder oil essentially acts as a lubricant by building up an oil film between piston rings and the cylinder liner wall.

The oil cleans through the inclusion of additives containing detergency agents and also acts as a neutralising agent to the sulphuric acid formed from condensation and the sulphur contained in fuel.

Changes in operating conditions such as a change in the fuel or changes to the engines operating pressure can impact the cylinder oil lubricant performance.

II. UNDERSTANDING THE RELEVANT LEGISLATION AND REGULATION

2.1 Fuel Sulphur Content and Sulphur Oxides (SOx) Emissions

The emission of sulphur oxides (SOx) from ships is regulated internationally by the International Maritime Organization (IMO) and on a regional level by attendant regulatory bodies.

Ship SOx emissions are formed in the combustion chamber of the engines due to the sulphur content present in fuel. The concentration of the SOx gases formed is directly linked to the fuel sulphur content.

Therefore, it is the reduction in the sulphur content of marine fuels upon which regulatory requirements for SOx emission reduction are based. The legislation also allows operators to comply with regulation by installing appropriate abatement technology

2.1.1 Emission Control Areas and The Global Sulphur Cap (MARPOL Annex VI, Regulation 14)

The International Convention of the Prevention of Pollution from Ships (MARPOL) Annex VI, Regulation 14 regulates the emission of SOx from ships through the enforcement of a global sulphur cap and the designation of Emission Control Areas (ECA) in which SOx, particulate matter (PM) and/or NOX emissions are limited.

Emission Control Areas

There are four MARPOL SOx ECAs:

• The Baltic Sea ECA

• The North Sea ECA

• The North American ECA

• The United States Caribbean Sea ECA

Within these four designated ECAs the permitted sulphur content of marine fuels used is 0.1%

Global Sulphur Cap

The current global sulphur cap requires marine fuels with a maximum 3.5% sulphur content to be used.

2.1.2 The EU Sulphur Directive 2012/33/EC

The European Union (EU) Sulphur Directive demands that ships operating in the Baltic Sea and North Sea ECAs use marine fuels with a maximum sulphur content of 0.1%. This requirement has been in force since January 1, 2015.

This legislation is applicable to all ships irrespective of flag, size or age.

For ships sailing outside of European SOx ECAs, but within European waters, the Directive dictates a maximum marine fuel sulphur content of 3.5%, in line with the global sulphur cap.

The only exception is passenger ships on a regular route which are required to use fuel with a maximum sulphur content of 1.5%

This is expected to change to 0.5% for all ships in 2020 or 2025, dependent on an upcoming announcement from the IMO in late 2016.

2.1.3 Hong Kong Air Pollution Control Regulation

The Hong Kong Government Environmental Protection Department has implemented the Air Pollution Control (Ocean Going Vessels) (Fuel at Berth) Regulation. This regulation took effect as of July 1, 2015.

The regulation requires all ships above 500 Gross Tonnes (GT) to switch to fuel with a sulphur content of no more than 0.5% while the ship is at berth apart from the first hour and the last hour of the time berthed. An alternative fuel such as marine gas oil (MGO) or liquefied natural gas (LNG) may also be used.

2.1.4 Future Emission Control Areas

China

In December 2015, China announced that it would establish an ECA in the Pearl River Delta, the Yangtze River Delta and the Bohai Bay waters. This has now been in effect since January 1, 2016.

The Chinese ECA is regionally legislated and not created under IMO MARPOL Annex VI ECA regulations.

It has a sulphur limit of 0.5%.

The ECA regulation limits are currently in force for ship berthing at the ports of Shanghai, Ningbo, Zhoushan, Suzhou and Nantong.

This will extend on 1 January, 2017, to ships berthing at further key ports within the ECA. As of 1 January, 2018, all ports within the ECA will be included.

Finally, at 1 January, 2019, all ships sailing within ECAs will have to use fuel of a maximum sulphur content of 0.5%.

The Rest of the World

The establishment of ECAs covering the entire Atlantic seaboard of Europe, the Mediterranean Sea, coastal Korea, the Sea of Japan, the Australian coast, the shipping lanes of Singapore, Malaysia and Indonesia have been speculated upon.

However, none of those listed above have placed firm intention of establishment as yet.

2.1.5 The 2020 or 2025 Global Sulphur Cap Reduction

In late 2016, the Marine Environment Protection Committee (MEPC) of the International Maritime Organization (IMO) is expected to take a decision on whether or not to implement the reduction in the global sulphur cap from 3.5% to 0.5% from January 1, 2020 or to postpone the implementation until January 1, 2025.

This reduction will force the global fleet to switch to using marine fuel with a maximum 0.5% sulphur content, such as low sulphur residual fuels, distillates and LNG, or by installing scrubbers.

2.2 Nitrogen Oxides (NOx) Emissions

The emission of nitrogen oxides (NOx) from ships is regulated both internationally by the International Maritime Organization (IMO) and regionally by attendant regulatory bodies.

Ship NOx emissions are produced in the engine as a result of the reaction of nitrogen and oxygen during fuel combustion.

2.2.1 NOx Emission Control Areas (MARPOL Annex VI, Regulation 13)

The International Convention of the Prevention of Pollution from Ships (MARPOL) Annex VI, Regulation 13 regulates the emission of NOx from ships through designation of NOx ECAs.

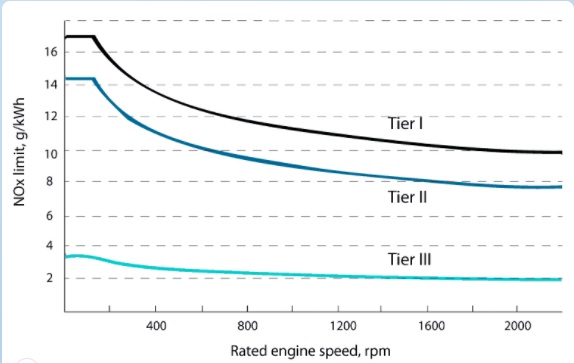

The legislation incorporates tiered stages of compliance that permit different levels of NOx emissions based on the ship’s construction date (or the installation date of additional or non-identical replacement engines) and the rated engine speed (RPM).

Regulation 13 applies to all installed marine diesel engines with a power output of more than 130kW, irrespective of the tonnage of the ship.

Tier I and Tier II regulations apply to global waters, whereas Tier III NOx emission limits apply only to ships constructed on or after January 1, 2016, operating in NOx ECAS.

There are currently two operational NOx ECAS: the North American ECA and the United States Caribbean Sea ECA.

MARPOL Annex VI NOx Emission Limits.

Source: AirClim, 2013

2.2.2 Future NOx Emission Control Areas

An Annual Meeting of the Helsinki Commission (HELCOM) agreed on a roadmap that included the submission of a proposal to the IMO for a Baltic NOx ECA in 2016, which is intended to take place in parallel to a similar NOx ECA submission from the North Sea countries.

No other NOx ECAs are under consideration at the current time.

2.2.3 United States Environmental Protection Agency, Clean Air Act

On January 1, 2014 the United States (US) Environmental Protection Agency (EPA) Tier 4 regulation entered into force.

This applies to large ocean going ships and any vessels flagged under the US and stipulates that PM and NOx must be reduced by a further 90% and 80%, respectively, compared with previous tiers.

To meet Tier 4 emission standards, engine manufacturers will produce new engines with advanced emission control technologies, often integrating engines with selective catalytic reduction (SCR) to meet the NOx reduction level required.

There are no current plans to modify the remit of the EPA Clean Air Act relating to marine vessels.

2.3 The Energy Efficiency Design Index and The Ship Energy Efficiency Management Plan

The Energy Efficiency Design Index (EEDI) and the Ship Energy Efficiency Management Plan (SEEMP) entered into force in January 2013.

The EEDI applies to new ships greater than 400 gross tonnes (GT) and varies with ship type, size and function.

It is a measure of the amount of carbon dioxide (CO2) emissions per tonne-nautical mile.

A smaller EEDI value means a more efficient ship in terms of energy consumption per tonne-nautical mile. A reference level was established for each ship type upon which incremental staged reductions are required every five years.

The regulation currently does not apply to passenger, mixed-use vessels (ferries, roll-on roll-off [Ro-Ro] ships or vehicle carriers, and cruise ships) and other specialty vessels for which deadweight tonnage is not an adequate representation of transportation capacity.

The staged EEDI targets are:

• An overall 10% improvement target in vessels' energy efficiency applies to new ships built between 2015 and 2019.

• Ships built between 2020 and 2024 will have to improve their energy efficiency between 15% and 20%, depending on the ship type.

• Ships delivered after 2024 will have to be 30% more efficient.

In addition to the EEDI regulation, the new Chapter 4 of Annex VI requires all ships or ship operating companies to develop and maintain a SEEMP, which provides a mechanism for monitoring efficiency performance over time and forces consideration of new technologies and procedures to optimise performance.

Your Comments

Other news

Mobil℠ Cylinder Condition Monitoring (CCM) – dịch vụ giám sát tình trạng xy lanh động cơ tàu biển do ExxonMobil phát triển. Dịch vụ giúp theo dõi chất lượng dầu xy ...

Minerva Gas đã làm gì để bảo vệ đội tàu LNG của mình và tối ưu hóa chi phí vận hành thông qua Chương trình Giám Sát Tình Trạng Xy lanh của Mobil (Mobil℠ ...

Mobilarma 798 là sản phẩm dầu chuyên dụng được thiết kế để bôi trơn và bảo vệ cáp thép trong các hệ thống nâng hạ, đặc biệt phù hợp với điều kiện ...

Our synthetic lubricants offer significant advantages over mineral oils - especially under extreme temperatures and pressures.

A lower GHG emission fuel

Mobil™ is a trusted supplier of high-performance cylinder oils and related services. They can also deliver the same level of support for your ancillary lubricant purchases.

Now easier to use, delivering improved insights and analytics - all in real-time. Learn how Mobil℠ Cylinder Condition Monitoring can help safeguard your engine operations, reduce costs and ensure ...

ExxonMobil's full line of environmentally acceptable lubricants (EALs) comply with the 2013 US Vessel General Permit (VGP) without compromising on performance.

Expanded testing helps ensure service users get the insights they need to maintain safe and efficient operations

ExxonMobil has revealed the three winners of the Marine Channel Partner Awards in 2023.

__CCM.png)

__1.png)

__z6633658534177_8c2f9f09731e8389685841b044e8e82b.jpg)

__bunkering_ship_front_screen_xl.jpg)

__PR-0009516-Bio-Marine-Fuel_1300x400.jpg)

__EM_Marine_LP_Header_Wave.jpg)

__hinh_backdrop.jpg)

__Y2meta.app-Mobil_SHCY_AwareY_lubricants_Y_delivering_compliance_and_performance-1080p_000051.jpg)

__1707321244452.jpg)

__1.jpg)